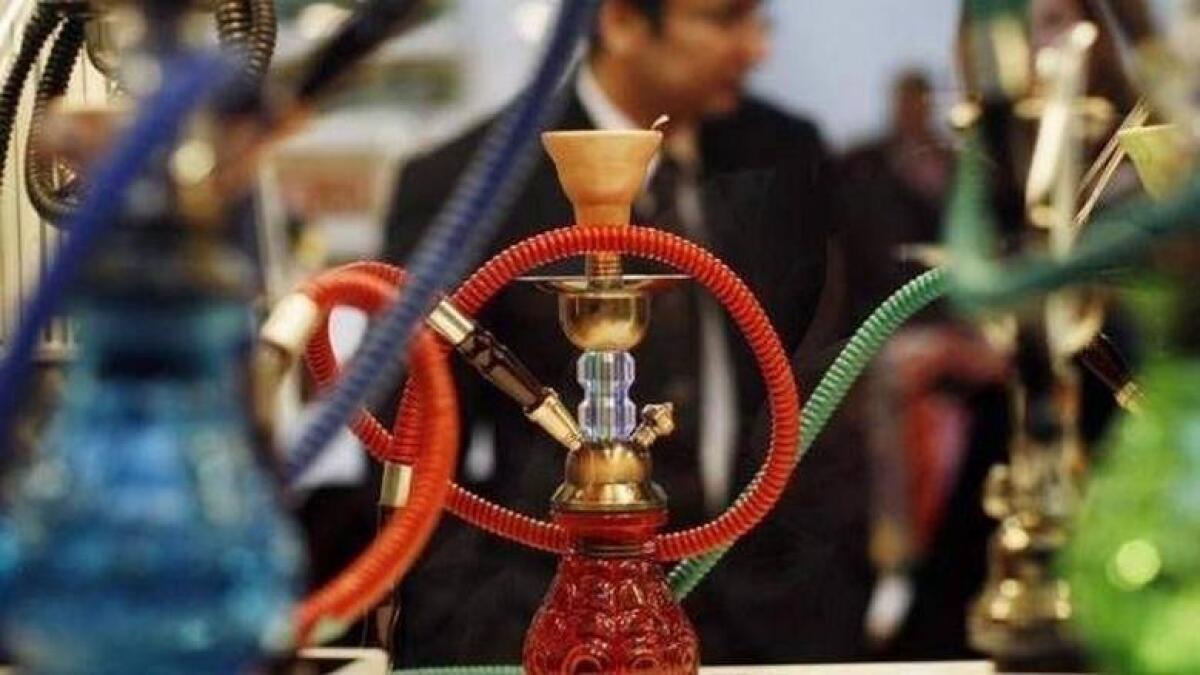

Excise duty is a consumption tax levied on specific harmful products such as carbonated drinks, energy drinks, sweetened beverages, tobacco products, smoking devices, and liquids used in these products. It is crucial for businesses to correctly identify and categorize these products to determine the appropriate excise rate. Tobacco products encompass a wide range of items derived from tobacco, including cigarettes, cigars, pipe tobacco, snuff, chewing tobacco, and smokeless tobacco. Smoking devices, like pipes, hookahs, and electronic cigarettes, are also subject to excise duty.

For excise tax purposes, carbonated drinks include all aerated beverages except unflavored aerated water, while energy drinks contain stimulant substances like caffeine and taurine. Sweetened beverages are products to which sugar or sweetener is added. Businesses must properly categorize these products to ensure the accurate application of excise tax rates. Factors like marketing materials, labeling, packaging, and descriptions can help determine whether a product falls under the category of energy drinks, carbonated drinks, or sweetened beverages.

If a product meets the criteria for multiple excise goods categories, it will be classified under the category subject to the highest tax rate. Alcohol and sparkling water are not considered excisable goods for excise tax purposes. It is essential for businesses dealing with excisable goods to categorize and tax these products accurately to comply with excise duty regulations. Any queries or clarifications regarding excise duty can be directed to Mahar Afzal, a managing partner at Kress Cooper Management Consultants.

In conclusion, excise duty plays a vital role in reducing the consumption of harmful products by levying taxes on items like tobacco products, smoking devices, carbonated drinks, energy drinks, and sweetened beverages. Proper identification and categorization of these products are necessary to determine the appropriate excise rates. Businesses must ensure accurate tax application by categorizing excisable goods correctly and complying with excise duty regulations. Consulting with experts like Mahar Afzal can provide clarity on excise duty matters and help businesses navigate excise tax requirements effectively.