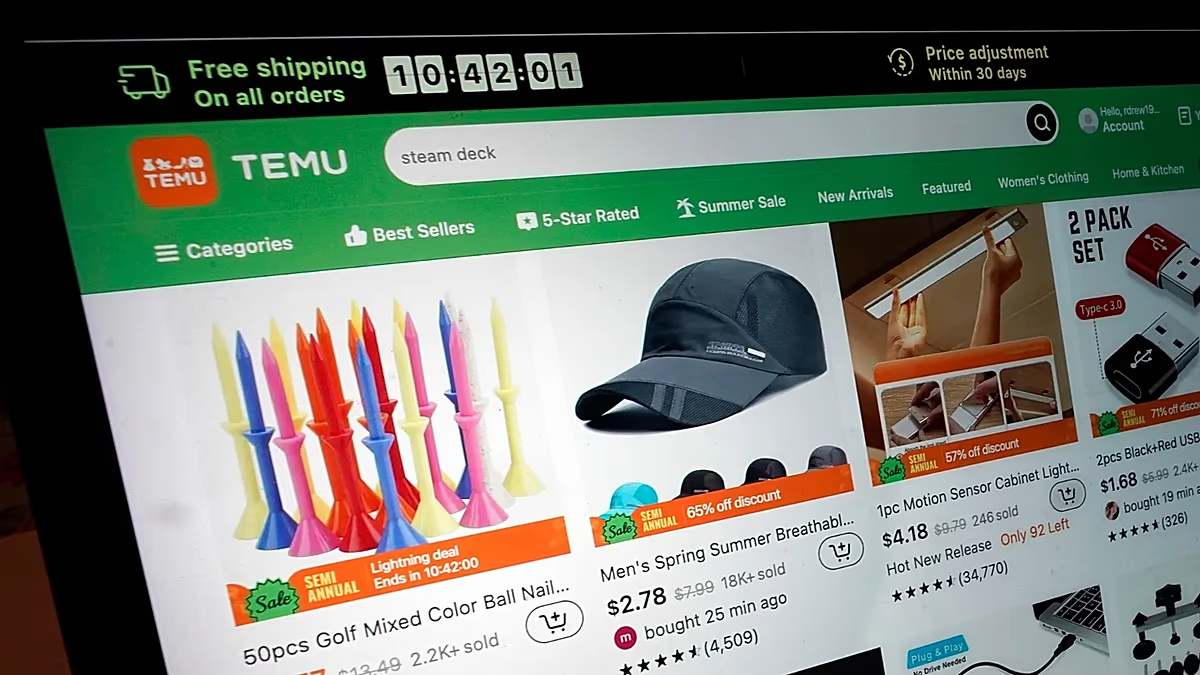

European Union member states have reached an agreement to implement a €3 tax on all parcels valued under €150 entering the bloc, effective July 1, 2026. This move directly targets the surge in low-cost e-commerce shipments, particularly from Chinese platforms like Temu and Shein, and aims to level the playing field for European businesses. The decision, finalized on Friday, represents a significant shift in the EU’s approach to cross-border online retail.

The new levy applies per parcel, not per item within the parcel, meaning a single shipment containing multiple products will be taxed once. This change comes as the volume of small e-commerce parcels entering the EU has dramatically increased in recent years, prompting concerns about unfair competition and lost revenue for local businesses.

The Rise of Low-Value E-commerce and the Need for a Tax

The growth of direct-to-consumer e-commerce from China has been exponential. According to European Commission data, approximately €4.6 billion worth of low-value items – those under €150 – were imported into the EU in 2024. This equates to an average of 12 million parcels arriving daily.

This represents a substantial increase from previous years, with €2.3 billion in imports in 2023 and €1.4 billion in 2022. The current exemption from customs duties on parcels below this value has been widely criticized for giving foreign sellers an unfair advantage.

Why the EU Acted

EU Trade Commissioner Maroš Šefčovič emphasized the importance of adapting to the evolving landscape of global trade. “With e-commerce expanding rapidly, the world is changing fast – and we need the right tools to keep pace,” he stated. The primary goal is to ensure fair competition for European retailers who are often subject to higher costs and stricter regulations.

Additionally, the EU aims to address concerns about the potential for tax evasion and the lack of transparency in the origin and value of these shipments. The influx of extremely low-priced goods has also raised questions about labor standards and environmental practices in the producing countries.

Temporary Measure, Long-Term Solutions

The €3 tax is described as a temporary measure, implemented while the EU works towards a more comprehensive and permanent solution for handling customs duties on low-value imports. Currently, the EU is exploring options for eliminating the existing customs duty relief threshold altogether.

The existing rules, which allowed for duty-free import of goods under €150, were increasingly seen as unsustainable given the sheer volume of parcels. The European Commission has been analyzing the impact of this exemption for some time, and the recent surge in imports accelerated the need for action.

Impact on Consumers and Businesses

Consumers can expect to see a slight increase in the cost of goods purchased from overseas retailers, particularly those offering very low prices. However, the €3 tax per parcel is unlikely to significantly deter online shopping, especially for items not readily available from European sources.

For businesses, the impact will vary. European retailers are likely to benefit from a more level playing field, potentially leading to increased sales and market share. However, some smaller European businesses that rely on importing components or finished goods from overseas may face slightly higher costs.

Chinese e-commerce giants like Temu and Shein have not yet publicly commented on the new tax. Analysts predict they will likely absorb some of the cost to remain competitive, potentially by adjusting their pricing strategies or optimizing their shipping logistics. The impact on their overall market share remains to be seen.

The implementation of this tax is part of a broader effort by the EU to regulate the digital economy and address concerns about unfair trade practices. The EU is also considering other measures, such as increased scrutiny of product safety and environmental standards for imported goods. For more information on EU trade policy, visit the European Commission’s Trade website.

Looking ahead, businesses and consumers should monitor the development of a permanent solution for customs duties on low-value imports. The EU’s ongoing discussions will likely shape the future of cross-border e-commerce within the bloc. Stay informed about these changes to adapt your strategies and navigate the evolving regulatory landscape.