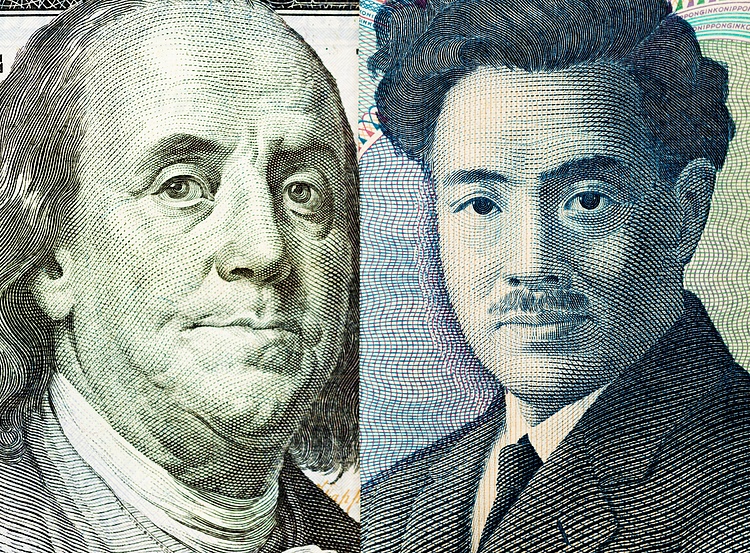

The USD/JPY pair is trading around 154.45 on Thursday as the US Dollar faces selling pressure due to softer US CPI inflation data. However, the pair recovers slightly following weaker-than-expected Japanese GDP numbers for the first quarter of 2024. Japan’s economy contracted by 0.5% QoQ in Q1, weaker than the expected 0.4% contraction, leading to selling pressure on the Japanese Yen. The US CPI inflation eased to 3.4% YoY in April, in line with market expectations, raising the odds for a Federal Reserve rate cut in 2024.

The USD/JPY pair is currently trading around 154.45 as the US Dollar is under pressure from softer US CPI inflation data. The pair has recovered slightly after Japan’s GDP numbers for Q1 of 2024 came in weaker than expected, leading to selling pressure on the Japanese Yen. The US Consumer Price Index (CPI) inflation eased to 3.4% YoY in April, in line with expectations, which has increased the likelihood of a Federal Reserve rate cut in 2024. Fed Chair Jerome Powell has indicated that the Fed may hold rates higher for longer to achieve the central bank’s 2% inflation target.

Japan’s economy contracted by 0.5% QoQ in Q1 of 2024, weaker than the expected 0.4% contraction, leading to selling pressure on the Japanese Yen. The weaker-than-expected GDP numbers have caused the USD/JPY pair to trim losses and recover slightly. Meanwhile, the US CPI inflation eased to 3.4% YoY in April, in line with market expectations, raising the odds for a Federal Reserve rate cut in 2024. Investors are now pricing in a 72% chance of a rate cut by the Fed in September 2024, up from 65% before the release of the US CPI data.

The softer US CPI inflation data has led to some selling pressure on the US Dollar, with the USD/JPY pair trading around 154.45. However, the pair has recovered slightly after Japan’s GDP numbers for Q1 of 2024 came in weaker than expected, causing selling pressure on the Japanese Yen. The US CPI inflation eased to 3.4% YoY in April, in line with market expectations, increasing the likelihood of a Federal Reserve rate cut in 2024. Fed Chair Jerome Powell has indicated that the Fed may hold rates higher for longer to achieve the central bank’s 2% inflation target.

Japan’s economy contracted by 0.5% QoQ in Q1 of 2024, weaker than the expected 0.4% contraction, leading to selling pressure on the Japanese Yen. The weaker-than-expected GDP numbers have caused the USD/JPY pair to trim losses and recover slightly. The US CPI inflation eased to 3.4% YoY in April, in line with market expectations, raising the odds for a Federal Reserve rate cut in 2024. Investors are now pricing in a 72% chance of a rate cut by the Fed in September 2024, up from 65% before the release of the US CPI data.