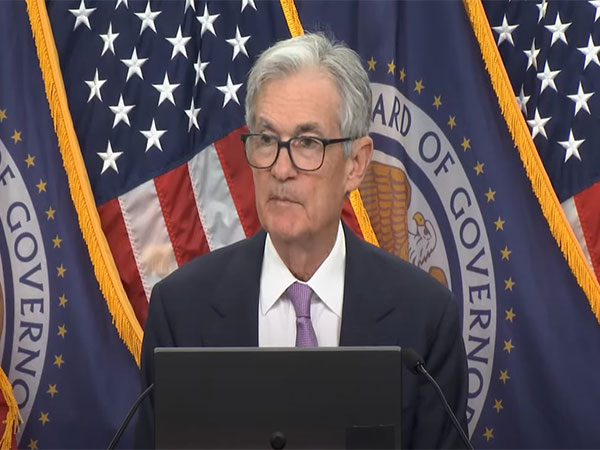

The US Federal Reserve has recently made the decision to lower its policy interest rate by 25 basis points in an effort to support economic stability and promote sustainable growth. This move by the Federal Open Market Committee (FOMC) has lowered the federal funds rate target to a range of 4.5 per cent to 4.75 per cent. Fed Chair Jerome Powell has stated that this decision reflects the Fed’s commitment to fostering economic growth and moving inflation towards the long-term goal of 2 per cent.

The Fed’s decision comes amidst recent indicators of solid economic growth and a steady expansion in labor market conditions. Although the unemployment rate has seen a modest increase, it remains relatively low, signaling a healthy job market. Inflation has improved but has not yet reached the Fed’s target, indicating that the central bank is navigating a delicate balance as it adjusts its monetary policy. The Committee remains focused on achieving maximum employment and stable, low inflation in the long run.

The FOMC has acknowledged uncertainties in the economic outlook and potential risks to its employment and inflation goals. The Committee emphasized that it would closely monitor incoming data, particularly in relation to labor markets, inflationary pressures, and international developments. Looking ahead, the FOMC signaled that it would carefully consider additional adjustments to the federal funds rate based on evolving economic conditions and potential risks to its dual mandate.

The Fed will continue to reduce its holdings of Treasury securities, agency debt, and mortgage-backed securities as part of its plan to gradually unwind its balance sheet. As Powell emphasized, the Fed remains attentive to a wide array of factors in the US economic outlook. The Committee’s decisions will weigh data on employment and inflation while assessing global financial and economic conditions. The latest rate cut by the Fed reinforces its flexible and cautious approach as it aims to foster a resilient US economy amidst a changing economic landscape.